All Categories

Featured

If you're going to use a small-cap index like the Russell 2000, you might wish to stop briefly and think about why an excellent index fund company, like Vanguard, doesn't have any kind of funds that follow it. The factor is because it's a poor index.

I have not even addressed the straw male right here yet, and that is the fact that it is relatively unusual that you really have to pay either tax obligations or significant commissions to rebalance anyhow. The majority of intelligent capitalists rebalance as much as possible in their tax-protected accounts.

Pacific Life Indexed Universal Life

Decumulators can do it by taking out from possession classes that have succeeded. And certainly, no one needs to be buying crammed mutual funds, ever. Well, I hope posts like these help you to translucent the sales methods typically utilized by "monetary specialists." It's really regrettable that IULs do not work.

Latest Posts

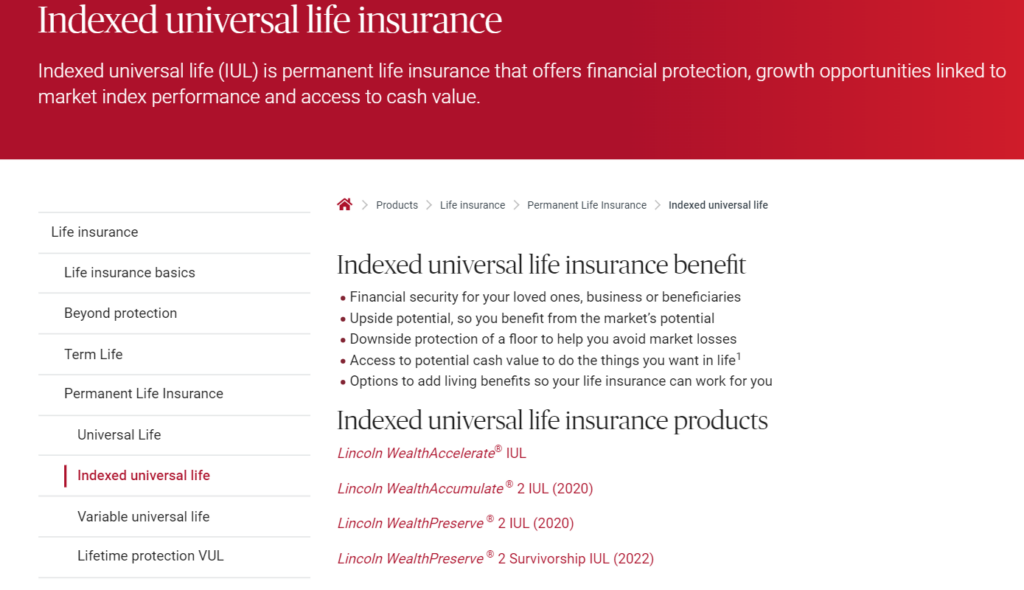

Variable Universal Life Vs Indexed Universal Life

Universal Life Insurance Ratings

Guaranteed Universal Life Insurance Rates